Read our region-by-region economic outlook and latest forecasts for investment returns…

The effect of higher central-bank interest rate targets is likely to send the U.S. economy into a mild recession in 2024 but also should help to further curb inflation and, in the second half of the year, allow the Federal Reserve to cut its policy rate. At the end of their cutting cycles, however, the rate targets of the Fed and other developed-market central banks are likely to be higher than we’ve grown accustomed to in recent years.

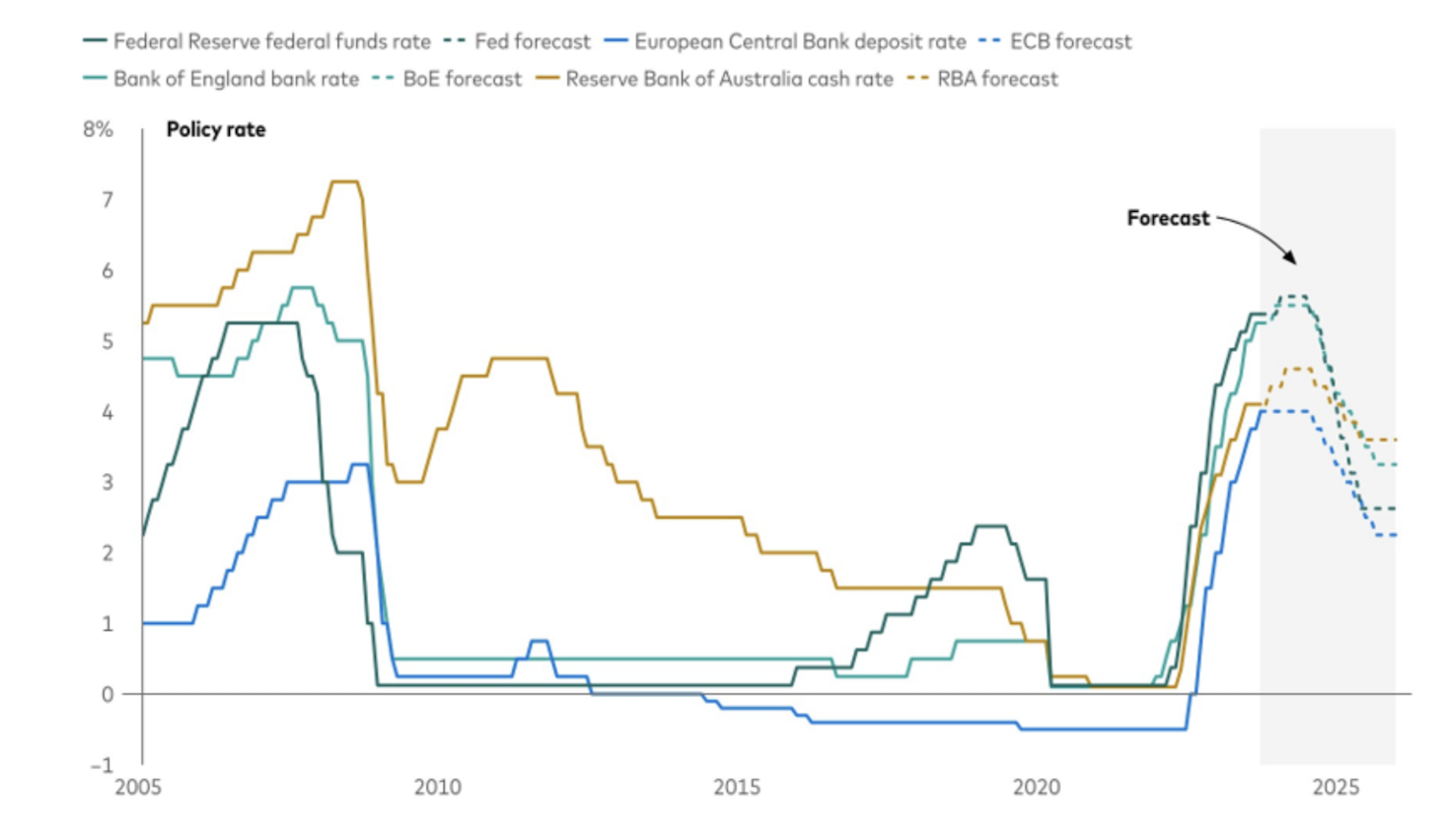

Where we see central bank interest rates settling

Notes: The chart shows actual central bank policy rates for January 2005 through October 2023 and Vanguard rate forecasts thereafter through December 2025.

Sources: Bloomberg (for historical data) and Vanguard (forecasts).

“The transition to a higher-interest-rate environment isn’t complete, and financial market volatility is likely to remain elevated in the near term,” said Andrew Patterson, Vanguard senior international economist. “But it will usher in a return to sound money that will endure beyond the next business cycle and serve long-term investors well.”

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of November 15, 2023.

Region-by-region outlook

Australia

Inflation remains too high, so the Reserve Bank of Australia (RBA) raised its cash rate by 25 basis points, to 4.35%, on November 7. In its monetary policy statement, the RBA said that inflation, particularly in the services sector, was “proving more persistent than expected a few months ago.” We anticipate a further 25-basis-point rate hike in February 2024, which would take the cash rate to 4.6%, before the RBA begins to cut rates in the second half of 2024.

Headline inflation is trending downward, but the RBA projects that it won’t fall to 3%—the top of the bank’s 2%–3% target range—until 2025. We’re more optimistic, expecting rates of price increases to trend back to the top of the RBA’s target range by the end of 2024, though headline inflation will likely fluctuate alongside volatile items including fuel prices.

The unemployment rate fell to 3.6% on a seasonally adjusted basis in September, the Australian Bureau of Statistics reported October 19, down from 3.7% in August. We expect an unemployment rate that touched 50-year lows after the pandemic to rise throughout 2024 as financial conditions continue to tighten in a higher-rate environment.

Gross domestic product (GDP) grew 0.4% on a seasonally adjusted basis in the second quarter, the Australian Bureau of Statistics reported. For the fiscal year ended June 30, GDP grew by 3.4%, above the 10-year pre-pandemic average of 2.6%. We expect GDP growth of 0.75%–1.25% for all of 2024 and see the probability of a recession over the next 12 months as about 40%.

United States

Robust economic output in the third quarter and a lack of indications that consumption has moderated yet in the fourth have led us to increase our forecast for full-year 2023 economic growth, to 2.5% in real (inflation-adjusted) terms.

On November 1, the Federal Reserve maintained its 5.25%–5.5% target for short-term interest rates. We believe the near-term bar for additional rate increases is high and have lowered our forecast of the Fed’s peak rate target, to a range of 5.5%–5.75% from 5.5%–6%. We continue to believe the Fed won’t be in position to consider rate cuts until the second half of 2024.

Falling goods prices, slowing housing cost increases, and moderating services prices reflected in the October Consumer Price Index data should increase the Fed’s confidence about its path for achieving its 2% inflation target.

The labour market appears to be near a turning point. Trends in the numbers of people working part-time for economic reasons, the long-term unemployed, and those who have stopped looking for work suggest the unemployment rate could increase by half a percentage point in the next six months. We believe such an increase is inconsistent with a “soft landing” scenario, or the avoidance of recession. But we continue to believe that, given structural labour supply considerations, the unemployment rate is unlikely to rise to a level as high as that typically associated with recessions.

China

A mixed picture of economic data released November 15 suggests China’s economy is gaining momentum after recent government stimulus. Retail sales increased by 7.6% year-over-year in October, the National Bureau of Statistics reported, far stronger than 5.5% growth in September and above consensus estimates. Industrial production remained resilient, but fixed asset investment moderated, weighed upon by a sluggish property sector.

Economic data released early this month hinted at progress. Gross domestic product grew 1.3% on a seasonally adjusted basis in the third quarter compared with the second, a reading that would seem to ensure full-year growth that reaches the government’s “around 5%” 2023 target. We anticipate further stimulus as policymakers look to carry momentum into 2024.

Other recent data suggest the economy isn’t yet on its front foot. Purchasing managers’ index data released November 1 revealed slowdowns in manufacturing, construction, and services activity in October compared with September.

Recent inflation data suggest tepid consumer demand amid strained household balance sheets. Core inflation, which excludes volatile food and energy prices, rose by just 0.6% compared with a year earlier, when China was in the throes of Covid-19 lockdowns. We believe recent stimulus efforts and a low 2023 base will lift year-over-year price changes in 2024, though we expect inflation to remain well below the People’s Bank of China’s 3% target.

Euro area

Signs of subdued economic activity continue, allowing the European Central Bank (ECB) to leave its deposit facility rate unchanged at 4% on October 26, its first pause after 10 consecutive rate increases. We maintain our view that the ECB will maintain that rate at least until the second half of 2024.

The pace of headline inflation decelerated significantly in October, to 2.9% compared with a year earlier. Core inflation, which excludes volatile food and energy prices, eased less dramatically, to 4.2%. We foresee core inflation falling to the mid-3s by year-end 2023 and to near the ECB’s 2% target by year-end 2024.

Gross domestic product contracted 0.1% on a seasonally adjusted basis in the third quarter compared with the second, according to the European Union’s statistical agency. We expect a further contraction in the fourth quarter, which would signal an economy in recession.

Unemployment rates were marginally higher in most euro area nations in September compared with August. We expect unemployment to rise to an above-consensus range of 7%–7.5% in 2024, illustrating our skepticism that a “painless disinflation” is attainable.

United Kingdom

Restrictive monetary policy is showing its effects through stalled economic growth and a slowdown in the labour market. But stickier-than-expected wage growth that has kept services inflation too high reinforces our view that policy interest rates will remain at their peak well into 2024.

The Bank of England (BOE) maintained its 5.25% bank rate for a second consecutive meeting on November 2. After two years of rate hikes totaling more than five percentage points, we believe the BOE has reached its peak rate. We don’t foresee the BOE being in position to cut the bank rate until mid-2024 at the earliest.

The year-over-year pace of headline inflation slowed considerably in October, the Office for National Statistics (ONS) reported. The Consumer Prices Index rose by 4.6%, down from 6.7% in September. Core inflation cooled as well, though less considerably.

The first estimate of third-quarter gross domestic product (GDP) showed economic growth slowing to a standstill compared with the second quarter. On a monthly basis, GDP increased in both August and September, following a sharp 0.6% decline in July.

The unemployment rate was largely unchanged at 4.2% in the July-to-September period, the ONS reported. Citing “increased uncertainty” around its traditional surveys, the ONS used a new methodology that relies on real-time payroll and unemployment benefits data. There are recent signs of loosening in the labour market, however. Employment growth declined, and vacancies fell in 16 of 18 industry sectors.

Emerging markets

Interest rate cuts in Brazil and Chile foreshadow our views for emerging market economies in 2024. Emerging markets were quicker than developed markets to raise interest rates in the face of soaring inflation. We expect Latin America and emerging Europe to cut rates modestly through 2024 as restrictive monetary policy raises concerns about growth. We expect central banks in emerging Asia to remain on hold longer.

Banco Central do Brasil reduced its policy rate by 50 basis points for a third straight meeting on November 1, to 12.25%. The bank emphasised growing global challenges from higher long-term interest rates in the U.S., persistently high core inflation in many countries, and new geopolitical tensions.

Banco Central Chile also cut its policy rate by 50 basis points, to 9%, on October 26. With inflation falling—to 5.5% headline and 6.6% core—in September, and with two-year inflation expectations remaining anchored, the bank said its new policy rate was consistent with returning inflation to its 3% target.

The Bank of Mexico left its target for the overnight interbank rate unchanged at 11.25% for a fifth consecutive policy meeting. While acknowledging progress on lowering inflation, the bank emphasised that the current rate remained appropriate for its goal of returning inflation to its 3% target by the end of 2025.

We continue to foresee 2023 economic growth around 1.8% in Latin America (where we are more optimistic than the consensus), 1.7% in emerging Europe (below consensus), and 5.25% in emerging Asia (near consensus).

Canada

The effects of monetary policy tightening have begun to clamp down on growth. Real gross domestic product (GDP) contracted by 0.2% on an annualised basis in the second quarter compared with the first, and monthly figures since then have suggested growth at a standstill. We anticipate that Canada’s economy could be in a technical recession of two consecutive quarters of contraction by year-end.

Headline inflation slowed to 3.8% in September compared with a year earlier, down from a 4.0% pace in August. Trimmed mean CPI, a measure of core inflation that excludes items at the extremes, rose 3.7% in September, down from 3.9% in August. We expect inflation to continue to moderate as the impacts of policy tightening take greater hold. Risks remain from higher shelter costs, however. Higher interest rates have raised mortgage interest costs and rents remain elevated because of continued housing shortages.

The unemployment rate rose by two-tenths of a percentage point, to 5.7% in October, a fourth increase in the last six months, as a net 18,000 jobs were created. We expect inflation to slow at a cost of a rising unemployment rate in 2024.

Vanguard’s outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. They are based on the June 30, 2023, running of the Vanguard Capital Markets Model® (VCMM). Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50thpercentile. More extreme returns are possible.

Australian equities: 4.2%–6.2% (21.7% median volatility)

Global ex-Australia equities (unhedged): 4.8%–6.8% (19.4%)

Australian aggregate bonds: 3.8%–4.8% (5.5%)

Global bonds ex-Australia (hedged): 4.0%–5.0% (4.7%)

The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Important information

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk. Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2023 Vanguard Investments Australia Ltd. All rights reserved.