Recent volatility in the stock and bond markets has some pundits questioning the wisdom of strategic asset allocation, in which a portfolio adheres to a prescribed mix of stocks and bonds. Phrases like “the death of 60/40” are catchy and can sound appealing during difficult market environments.

The evidence is clear

But such statements, which tend to promote tactical adjustments to an asset allocation, focus on short-term performance and aren’t supported by research or experience.

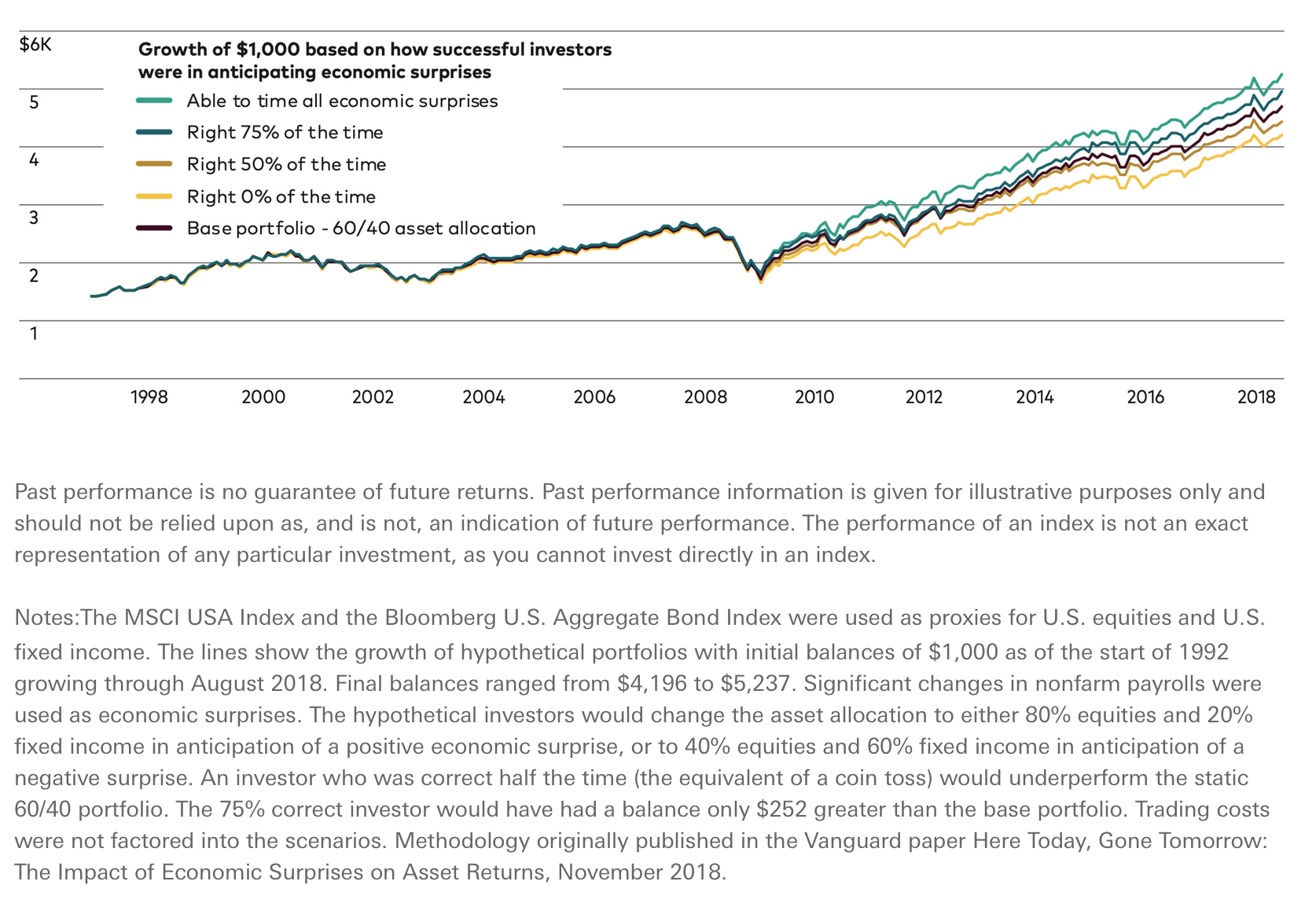

In theory, tactically adjusting long-term portfolios during periods of market turbulence may seem like a good idea. But in reality, adjusting a portfolio’s asset allocation to enhance returns in the short term is very difficult to get right consistently. Research has shown that such moves—which amount to market timing—are counterproductive over time (refer Figure 2).

Two approaches to asset allocation

Strategic asset allocation and tactical asset allocation are different methods to maintain a multi-asset portfolio. Strategic asset allocation involves setting target allocations across various asset classes and rebalancing the multi-asset portfolio regularly to stay close to the assigned allocation through all market conditions.

Vanguard’s Diversified ETFs and managed funds employ this strategic approach to bolster financial wellbeing for those saving for retirement. Our philosophy rests on the evidence that a sound investment strategy starts with an asset mix built on reasonable expectations for risk and return and uses diversified investments to help avoid exposure to unnecessary risks. This strategic approach should remove the temptation to make tactical adjustments when markets are roiling. We believe this is the most prudent way for diversified funds to achieve their long-term objective.

In contrast, tactical asset allocation encourages adjustments to a portfolio’s asset mix based on short-term market forecasts. This approach aims to systematically exploit perceived inefficiencies or temporary imbalances in values among different asset or sub-asset classes. It seeks to take advantage of market trends or economic conditions by actively shifting a portfolio’s allocations across or within asset classes.

However, tactical shifts made with the expectation of exploiting short-term market moves is much easier said than done. And importantly, it adds a degree of active management risk. Diversified ETFs and managed funds serve a large and diverse investor population, so we believe it’s important to minimise additional risk wherever possible.

A look at the primary driver of long-term results

Of these two approaches to asset allocation, Vanguard’s Diversified ETFs and managed funds have always emphasised a strategic approach. The primary reason: Research has consistently shown that the mix of assets in broadly diversified portfolios is by far the greatest determinant of both total returns and return variability over the long term; In addition to the seminal research conducted by Brinson, Hood, and Beebower in 1986, Vanguard’s own study1 Vanguard’s Framework for Constructing Globally Diversified Portfolios (2021), shows that over time, more than 90% of a portfolio’s return variability can be explained by its strategic asset allocation. Conversely, short-term tactical investment decisions, such as market-timing and security selection, had relatively little impact on return variability over longer time frames.

Understanding Vanguard’s strategic asset allocation process

For multi-asset funds, such as Vanguard Australia’s Diversified ETFs and managed funds, Vanguard’s Investment Strategy Group (ISG) conducts an annual review of the strategic asset allocation of the funds. The team considers new asset classes, currency exposure, home bias, regulatory and tax impact, investment costs, investor behaviours, and implementation factors amongst others. The ISG team presents a recommendation to maintain or change the strategic asset allocation to Vanguard’s global Strategic Asset Allocation Committee (SAAC), which oversees all of Vanguard’s multi-asset funds. The SAAC is comprised of senior leaders from the Investment Management Group and Vanguard’s advice businesses and is co-chaired by Vanguard’s Global Chief Investment Officer and Global Chief Economist. Upon approval of a change to the strategic asset allocation, Vanguard assesses the feasibility, tax impact, and costs of the recommended changes and presents to the Board of Vanguard Australia for approval prior to implementing the changes.

Tactical allocation is difficult to get right consistently

Some investment managers aren’t content with strategic asset allocation and believe that adjusting asset allocation can further improve returns. They incorporate tactical or dynamic tilts. These active management approaches may seem like a sensible way to navigate short-term market movements, but they involve an inherent market timing decision that is difficult to get right consistently.

Here’s why. First, to add value, a tactical approach must overcome implementation costs, including bid/ask spreads, commissions, etc.

Second, because markets can be so unpredictable, relying on specific market signals over short periods of time can be challenging over the long term—which is exactly what diversified ETFs and managed funds are designed for. And when tactical moves don’t work, the damage can be long-lasting. If investors were out of the stock market for just the best 30 trading days in modern history, they would have missed nearly half the returns over that period (see Figure 1). What’s more, the best days and worst days tend to be very close to one another.

Figure 1: Annualised returns of U.S. stock market from 1928 through 2021

Consequently, for any tactical move to be successful, managers need to be right not just once but at least five times:

Identify a reliable indicator of short-term future market returns.

Time the exit from an asset class or the market, down to the precise day.

Time re-entry to an asset class or the market, down to the precise day.

Decide on the size of the allocation and how to fund the trade.

Execute the trade at a cost (reflecting transaction costs, spreads, and taxes) less than the expected benefit.

Even if a portfolio manager can get these steps right most of the time, the value added over the long term is marginal. Vanguard has conducted research on the incremental benefits of market timing based on how frequently a hypothetical investor might be successful in anticipating economic surprises. In the hypothetical scenario presented in Figure 2, an investor would have to be correct 75% of the time or better—a very tall order!—to get a return only slightly higher than that of the traditional baseline portfolio of 60% U.S. equities and 40% U.S. fixed income.

Figure 2: Growth of $1,000 based on how successful investors were in anticipating economic surprises

The evidence for a strategic approach

Despite all the advantages of having professional asset managers—including analysts, sophisticated computer models that try to predict short-term trends, and other resources beyond those of the average investor—tactical allocation funds have generally posted lower median returns with greater return variation across managers than their counterparts with steadier strategic allocations (see Figure 3).

Figure 3: Distribution of annualised returns

The evidence is clear: Whether looking at short or long timeframes, strategic allocation funds have consistently generated higher median returns with less dispersion (less risk) than funds with tactical allocations.

The strategic approach remains key to our Diversified ETFs and managed funds

In designing a solution for the wide range of diversified ETFs and managed funds investors, we strongly believe in balancing the risks of investing with return expectations that appropriately compensate for those risks.

While a tactical approach does offer the chance to outperform the market, we consider the typical diversified investor to be averse to relying on higher-risk strategies. Making active bets that don’t work can end up discouraging investors from staying disciplined and riding out the inevitable short-term market declines.

Our ongoing research on retirement investing continues to reaffirm our conviction that tactical shifts in a balanced and diversified portfolio is much less effective in achieving investment goals than encouraging clients to increase their savings rate or adjust their return expectations.

In summary, strategic asset allocation has endured for a reason. It’s been reaffirmed by academic research and has outlasted numerous bear markets. That’s why the strategic approach remains a key investment principle underlying Vanguard’s Diversified ETFs and managed funds.

While some advisers may sometimes feel that this approach is overly passive, it’s certainly not laissez-faire. It has proven to be a reliable driver of long-term return variability and remains as effective as ever in helping investors seek lifelong financial wellbeing.

1. Vanguard research: 90% of return variation is driven by SAA. Source: Vanguard calculations, using data from Morningstar, Inc. Notes: For each fund in our sample, a calculated adjusted R2 represents the percentage of actual-return variation explained by policy-return variation. The percentage shown in the figure below represents the median observation from the distribution of percentage of return variation explained by asset allocation for balanced funds. The Australian market sample covered 682 balanced funds from January 1, 1990, through September 30, 2020. Calculations were based on monthly net returns, and policy allocations were derived from a fund’s actual performance compared with a benchmark using returns-based style analysis (as developed by William F. Sharpe) on a 36-month rolling basis. Funds were selected from Morningstar’s Multi-Sector Balanced category. Only funds with at least 48 months of return history were considered in the analysis. The policy portfolio was assumed to have an expense ratio of 2.0 bps per month (24 bps annually, or 0.24%).

Vanguard Investing