Financial & Retirement Advice in Perth…

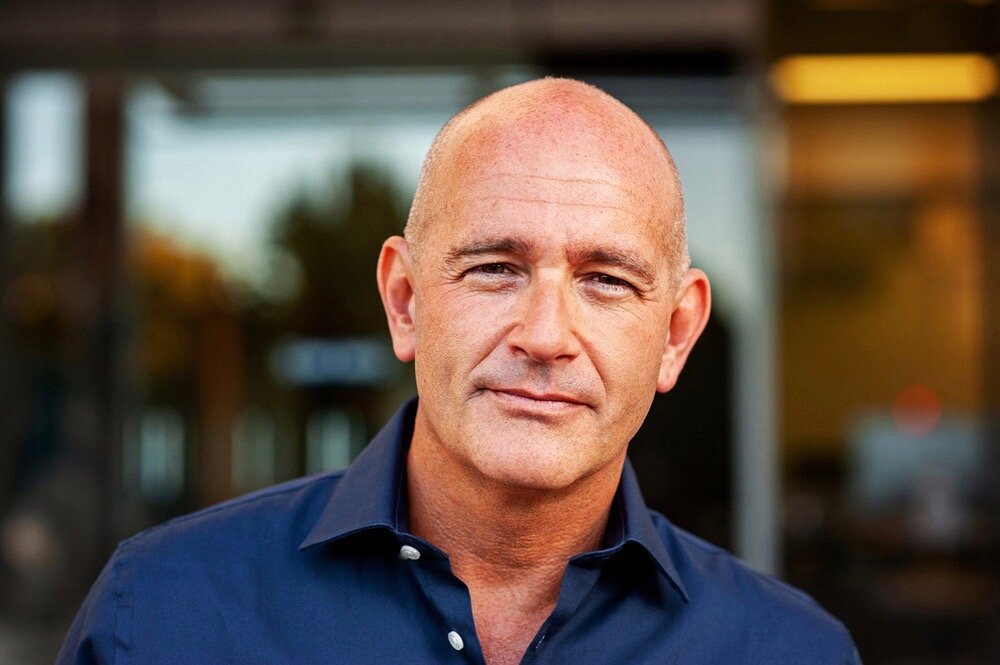

RICK MAGGI Certified Financial Planner, Managing Director of Westmount Financial (Perth CBD).

Perth-based Financial Advisor Rick Maggi has dedicated over 40 years to helping clients achieve financial independence, offering investment and retirement solutions that are both resilient and refreshingly simple to manage.

With experience guiding clients through various economic cycles, geopolitical shifts, and personal life changes, Rick understands the value of accessible, thoughtful financial advice and continuous support. Founded in 1977, Westmount Financial embodies this commitment to clarity and stability in financial planning.

A clear path FORWARD

Clarity is the cornerstone of success.

Your financial and retirement goals—whatever they may be—are far more attainable when your vision, priorities, and values are front and center in your decision-making process.

Research shows that individuals who work with a Financial Advisor often report greater happiness, increased wealth, and a stronger sense of control over their future. Reflecting this, the demand for authentic, goals-based financial advice has surged in recent years.

With an expanding range of financial planning services now available, consumer choice has never been better. While many Australians gravitate toward a more accessible and tailored approach, it’s essential to assess your unique circumstances carefully—after all, there’s no one-size-fits-all solution.

Keeping it simple

Taking the time to reflect on what truly matters to you should be an enjoyable and enriching experience—not a burden.

A seasoned Financial Advisor can help you gain clarity on your goals and design actionable strategies to achieve your desired lifestyle and retirement outcomes. They also provide consistent support for you and your family throughout your financial journey.

At Westmount, our mission is straightforward: to inform, simplify, and support. We strive to unravel the complexities of retirement planning and wealth management, empowering our clients with the knowledge and confidence to make sound financial decisions with ease.

If retirement has been occupying your thoughts lately, you’re likely picturing a future filled with travel, hobbies, well-deserved “me-time,” and finally savoring experiences you’ve put off for years. It’s a vision of clear skies ahead.

At the same time, you may be quietly running the numbers, wondering whether you can retire comfortably—or perhaps scale back to just a few days of work each week. If these thoughts resonate, now is the perfect moment to tackle these questions head-on.

By taking the time to unravel the retirement puzzle, you can not only fortify your financial outlook but also embrace a greater sense of calm, confidence, and certainty about the years ahead.

If you find yourself at this pivotal crossroads, seeking guidance from a seasoned Financial Advisor can provide invaluable clarity and a trusted second opinion.

2025: TIME FOR A RETHINK?

As the new year unfolds, the world faces a complex mix of economic and geopolitical challenges, including inflation, rising interest rates, a new U.S. president, and ongoing regional conflicts. Despite these uncertainties, Australia’s economy has remained resilient, avoiding recession and sustaining cautious optimism.

In times of uncertainty, stepping back to assess the broader landscape can bring valuable clarity and peace of mind. Keeping a measured distance from the noise of daily headlines and market speculation may, in itself, be one of the most prudent investment choices you could make.

Successfully navigating the year ahead will require thoughtful planning and a steady perspective. Consider partnering with an experienced Financial Advisor to help you stay on course, adapt to the inevitable market fluctuations, and remain focused on your long-term financial aspirations.

Rick Maggi CFP, Financial Advisor (Perth), Westmount Financial.

Vince & Julie (Mosman Park)

Alan (Launceston)

Lee & Val (Mosman Park)

David & Rae (Dunsborough)

Peter & Carol (Swan Valley)

Ron & Shirley (Banjup)

David & Joanna (Helena Valley)

Lorna & Lionel (Piesse Brook)

News Updates…

Tread carefully, SMSF breaches are under the microscope for SMSF trustees…

A positive development on the retirtement planning front…

Recent market volatility should be taken seriously, but there is a flipside…

The fear of ruiing out of money in retirement is a key issue for many Australians…

Today the RBA cut the cash rate for first time since 2020, marking the start of an easing cycle...

This week’s analysis from Betashares…

This note takes a look at some of the main questions investors have in a simple Q&A format, particularly around tariffs, the RBA and gold…

An extensive market commentary and economic outlook from Betashares (a good read)…

People are back to spending, adding another layer of complexity to the inflation/interest rate cut equation…

Improving affordability, rising incomes and potenbtial interest rate cuts should drive growth this year…

A step by step guide to shifting your super to pension mode…

With gold prices surging, is it time for a rethink?

If the banks are right, we’re in for a modest rate cut later this month…

Could Donald Trump’s trade war impact Australia?

Tech had a rough week, but its important to have the right perspective…

US stocks fell on Friday and more so overnight due to a major new threat to the prevailing AI narrative…

Vanguard expects Australia’s GDP will gradually recover this year…

The start of 2025 is a good opportunity to take decisive financial steps…

A bullet point summary of 2024, and a look ahead to 2025…

US ecomnomic outlook for 2025…

Vanguard’s latest forecasts for investment returns and rion-by-region economic outlook…

Retirement is multi-dimensional and deserves deeper thinking…

If money’s too tight to mention, here’s some small steps that can make a big difference in achieving your financial goals…

If you’re looking to build a diversified investment portfolio, here are five steps to get you started…

So what can you potentially do to get more into your super? Here are six options…

It can be scary out there - markets are volatile, and fears are rising. So how can you push past the fear and begin investing?