While investing in the stock market is typically a prudent choice for investors seeking long-term growth, sharp drops can still be hard to stomach. Below are some things to keep in mind if a market tumble makes you feel the need to "do something."

Some of the charts below use U.S. data, but we believe the broad findings we draw from them generally hold across the globe. That's because the United States is the largest and most mature financial market in the world and has robust data allowing us to perform rigorous research across numerous market cycles.

Downturns aren't rare events: Typical investors, in all markets, will endure many of them during their lifetime.

Dramatic market losses can sting, but it's important to keep a long-term perspective and stay invested in order to participate in the recoveries that typically follow.

Some bear markets since 1980 have been sharp, but many bull market surges have been even more dramatic, and often longer, leaving stock investors well compensated over the long term for the risk they took on.

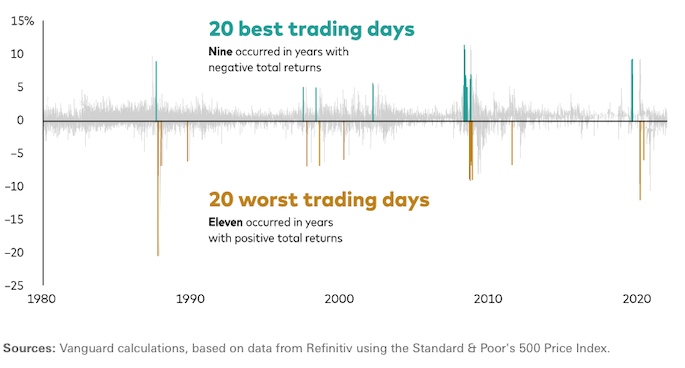

Timing the market is futile: The best and worst trading days often happen close together and occur irrespective of the overall market performance for the year.

As the random pattern of returns below highlights, predicting which segments of the markets will do well is also a tough order.

Broad diversification keeps you from having too much exposure to the worst-performing areas of the market in the event of a downturn.

Riding out the rough periods can pay off. That includes rebalancing into asset classes even when they are declining instead of pulling out of the market.

What you can do when volatility hits:

Following these simple steps can help you avoid overreacting to short-term downturns and position you for long-term success.

Notes: All investing is subject to risk, including possible loss of principal. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Diversification does not ensure a profit or protect against a loss. Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Vanguard Australia