Why you shouldn’t put all your investment eggs in the one basket…

The Spanish writer Miguel de Cervantes Saavedra isn't widely regarded as a renowned investment strategist.

But it's in his most famous literary work Don Quixote, published in 1605, that one of the quintessential investment phrases, still widely used today, first emerges.

Through the novel's central character, he advises that it's never wise to put all your eggs in one basket.

Diversification, spreading your money across a range of different assets rather than putting it all into one place, is one of the core principles of investment risk management.

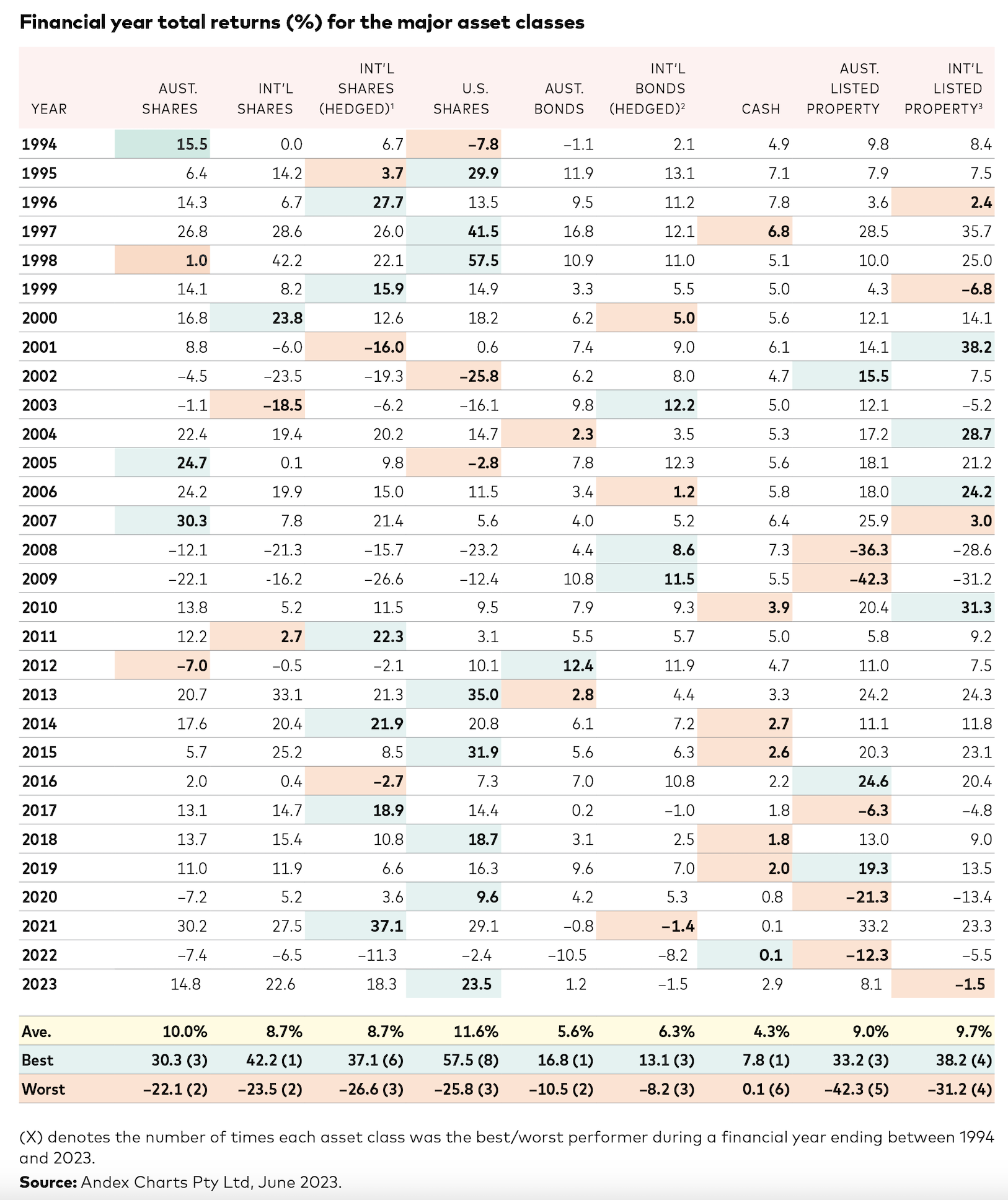

That's because investment returns from different assets are never consistent.

Let's take a look at some of the asset class returns from the 2022-23 financial year. The best-performing asset class was United States listed shares, which returned 23.5% The worst-performing assets were international bonds (hedged) and international listed property, which both fell 1.5%. Australian shares gained 14.8%.

But if you compare those results with the previous year, it was a very different story. Cash was the best performer, gaining 0.1%. Australian listed property was the worst performer, falling 12.3%, while international shares (hedged) fell 11.3%.

In other words, asset class returns are ever-changing. So, having your investment money in several asset pots, instead of just one, will invariably smooth out your overall returns over time.

Getting the best mix

How you allocate your investment capital is one of the most important, and often difficult, decisions.

Your asset allocation strategy should always be in tune with your investment goals and your tolerance for taking risk.

Rather than trying to do it themselves, more and more people are investing across different asset classes such as Australian and international shares, listed property, fixed interest and cash using diversified exchange traded funds (ETFs) and unlisted managed funds.

Investing across a range of different types of investments helps to smooth out volatility.

A key advantage of diversified funds is that they give you the option of having higher or lower exposures to different assets, such as shares and bonds, depending on your individual tolerance for risk.

Diversified funds are versatile products that can be used as an all-encompassing single product portfolio, or as an extremely well diversified core building block with ‘satellite’ exposures around the edges.

They can help you to maintain a more disciplined approach to portfolio management, avoiding regular switches into and out of other assets. This allows you to have a more consistent risk profile, no matter how markets move.

Another advantage of diversified funds is that they’re relatively cost effective compared with the fees involved in buying and managing the asset allocations of multiple fund or individual investments.

Vanguard has four diversified fund options, which have been designed for investors seeking either conservative, balanced, growth or high growth asset allocations.

Each fund invests across seven to eight different funds, covering all of the major asset classes, to provide broad diversification.

If you’re unsure of whether you do have the right assets mix, consult a licensed financial adviser for some professional guidance.

___________________________________________

Important information and general advice warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer of the Vanguard ETFs and the Operator of Vanguard Personal Investor. We have not taken your objectives, financial situation or needs into account when preparing this publication so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for Vanguard ETFs before making any investment decision. Before you make any financial decision regarding Vanguard ETFs , you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard's financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the TMD for Vanguard ETFs before making any investment decisions. You can access our IDPS Guide, PDSs Prospectus and TMD at vanguard.com.au or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This publication was prepared in good faith and we accept no liability for any errors or omissions.

© 2023 Vanguard Investments Australia Ltd. All rights reserved.